We will take you through an exclusive Branch loan guide 2022. Branch app is an online money lender that provides instant loans to clients within a few minutes, we will guide you on how to get instant Branch loan.

Branch helps the middle-class with a clear vision to start or improve on their investment or any of the kind.

It launched an app, Branch App, that made its to be accessible World wide particularly in countries where it has been licensed to render its service.

The branch app since its launch in 2014 has had over 20 million downloads and officially operates in Kenya, India, Nigeria, and Tanzania with offices in Nairobi, Kenya; Lagos, Nigeria; Mumbai, India; and San Francisco, United States. They are however still expanding their reach in other countries across the continents as well.

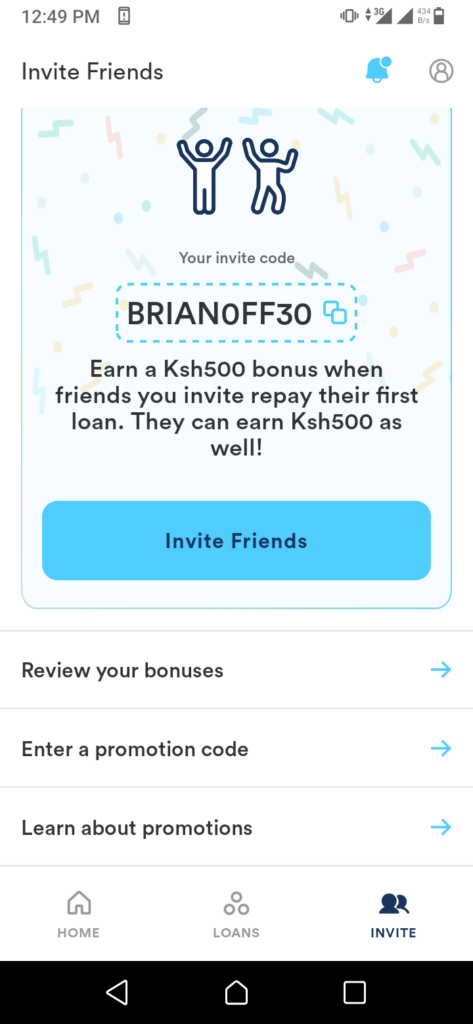

Despite being popularly known for online money lending, it gives a verified platform for money savings and also provides affiliate programs that allow already existing customers to make money for referrals.

Nevertheless, the branch saves time that would have otherwise been spent waiting in lines and the kinds of documentation evident in traditional banking. But they only give a simple questionnaire to be filled all of which get done within a few minutes.

How to join Branch and acquire instant loans / Branch guide on registration

Becoming a member of the Branch has been made easier by simply accessing their services on phone. They give out a relatively easy signup process where one only fill out the identities (name, phone numbers, etc)

To register, you need to download Branch Loan App, launch, and fill few details as prompted. Use BRIANOFF30 as promotion code during registration. (Discussed below)

Branch Loan Guide 2022- How does one make money with a branch?

With the branch app, it’s simple and much easier to grab some tangible amount with just a single click, then relax waiting for the branch to reward you for simply a seconds click.

Imagine minding your business and you get notified that the Branch has deposited some amount in your branch account directing you to withdraw or use it to pay for your existing loan? Thanks to referral program. Just click on ‘Invite friends’ and enjoy the bonus.

How Do Branch Determine Loan Amount Award To Customers?

Definitely, Branch can analyze your financial statements upon being granted permission to do so. The data fetched from your verified sim card are then used to determine the amount of loan you are eligible to be given.

In addition, they use handset details alongside repayment history to calculate your credit score for a lending offer.

You do not need to mind this particular stuff since their in-app algorithms process these data within seconds and display the amount that they believe you can easily repay on time. This ushers me on how their system protects the users’ data.

Branch Loan Guide 2022- Are Customers’ Data Secure And Private With Branch?

Branch prioritizes the safety of their esteemed customers above everything else. They value the privacy and security of the customers by making all the data encrypted and always protected.

Again, the branch admits to neither selling nor sharing the customers’ sensible data including contacts to 3rd Parties.

Lastly, you may for some reason fail to repay within the given time limits, no worries with branch. This is when you get to identify the friendly lenders, those lenders who will remind versus one who threatens and render no more time to understand your condition. Yeah.

Well, Branch does not condone any form of aggressive debt collection practices such as debt shamming. To show their seriousness to this, they urge any case of harassment to be reported in the app immediately for them to take faster actions.

RELATED: How to make money writing online

Branch Loan Guide 2022- Is Branch Transparent?

They give a clear and up-to-date detailed lending term and do not charge late fees or rollover fees.

Eligibility criteria / Branch loan guide on eligibility criteria

- Phone number or Facebook account.

- Bank account number if you prefer bank deposit

- Accept their request to access the data on your phone to build your credit score.

- Be at least 18 years old with a valid Identity Card

Branch Loan Limits and Interest Rates

Having serving different countries results in a gap in the possible maximum amount of money borrowed by their customers.

However, with interests, their system works with limited or no errors to ensure that the rate given to you during the borrow is verifiable in the resulting amount for repayment.

Repay Amount = Amount borrowed × Interest Rates (Given either per day, week, or month)

It is worth noting that these rates tend to decrease with time and this is basically the advantage of using a single loaning agent.

In Kenya

| Loan limit | Ksh. 250 – Ksh100,000 |

| Late/rollover fee | None |

| Monthly Interest | 1.7% – 17.6% |

| 4 – 52 weeks (Long-term) | 17% – 35% |

| APR | 22% – 229% |

In Tanzania

| Loan limit | Tsh.5,000 – Tsh.700,000. |

| Late/rollover fee | None |

| Monthly Interest | 4% – 25% |

| 4 – 52 weeks (Long-term) | 18.8% – 49% |

| APR | 53% – 319% |

In Nigeria

| Loan limit | ₦2,000 – ₦500,000 |

| Late/rollover fee | None |

| Monthly Interest | 1.5% – 20% |

| 4 – 52 weeks (Long-term) | 17% – 40% |

| APR | 18% – 260% |

In India

| Loan limit | ₹750 – ₹50,000 |

| Late/rollover fee | None |

| Monthly Interest | 2.8% – 3.1% |

| 4 – 52 weeks (Long-term) | 3% – 25% |

| APR |

Therefore, having known the interest rate that will be due to the loan, then it is considerate to now look into step-by-step procedure on how to apply and get an instant loan into your account or verified sim card number.

Guide On How To Apply For Branch Loan 2022

To get a loan from Branch online, you must download the Branch app from the Google Play store using your smartphone. Launch the App then proceed to;

Register or log in to the application using your phone number. One app only allows one account hence once on phone, consider logging in with the specific number that you intend to borrow with. However, this only applies to first-time borrowing.

Fill out the simple few questions or you may refer to the questionnaire to enhance processing of your eligibility. They include your details like; name, national ID number, date of birth, country, etc.

Then wait for a few seconds for Branch to get back to you with your eligible loan amount.

After validation (they get back to you), you will be directed to the loan page showing you the amount to borrow. Note that first-time applicants will automatically be awarded a lower amount. Don’t mind it since your limits will grow with time as you continue building your trust. Feel free to view also tips on how to increase your Branch App Loan HERE.

Next, select the amount you want to borrow i.e. select 1,000 depending on your country and then submit or forward.

Again, be patient for the next few seconds for the Branch to send a text message notifying you of your loan application status.

In case their system approves it, they will channel the amount to your preferred account i.e. verified sim card account or bank account.

Since lenders are willing to invest in a trusted community that will not only request a loan but also repay on the specified time limits. Repayment of the full loan is essential in building your loan scores for next time’s application.

Branch Loan Guide 2022- Enter Promotion code

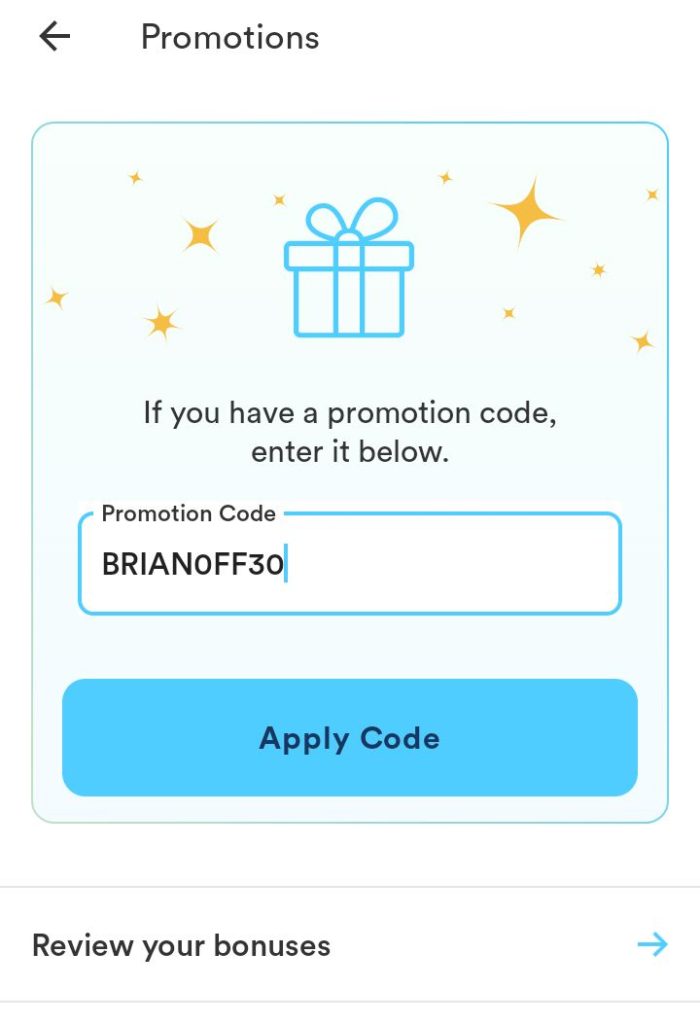

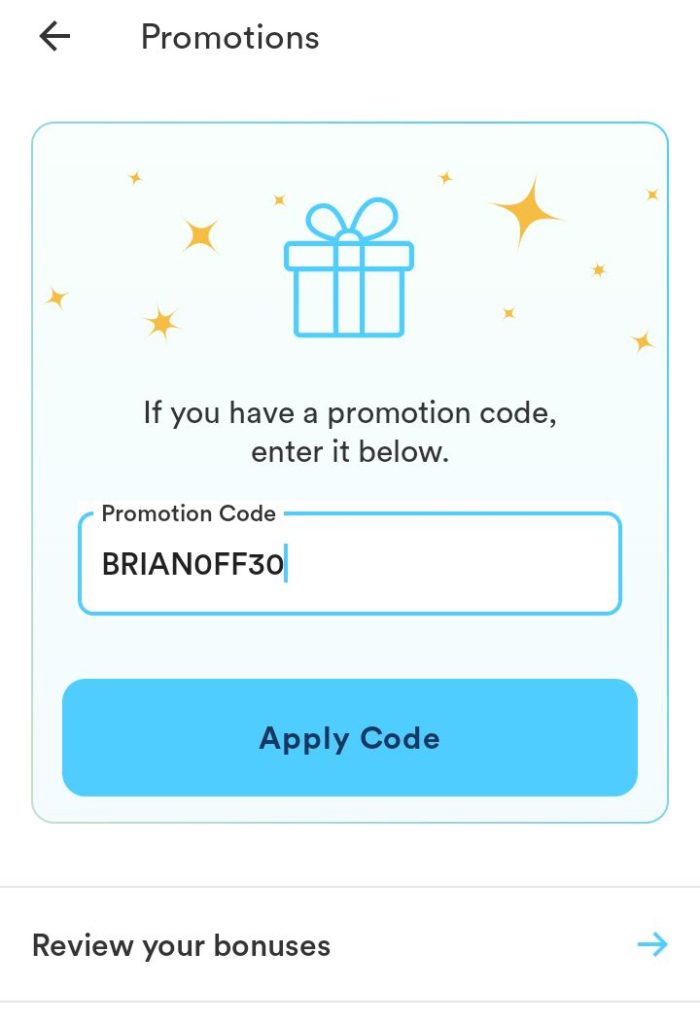

Note: Do not forget to fill on the promotion

To enter the promotion code;

- First tap on ‘My Account’ on the top right corner of the Branch app.

- Scroll down to promotion and enter BRIANOFF30. Then finish by clicking apply.

Again, don’t forget to navigate on ‘My Account’ and fill in the Profile, Financial Account, and finally, promotions to be able to secure your first Branch Loan.

Bonus: The interest rates will be automatically calculated for you and displayed, so no worries about the return amounts. Super cool.

Branch Loan Guide 2022- Guide To Repay Branch Loan

In this section, we gonna show you how to make payment when settling the borrowed amounts. We’ll cover repayments via Branch App and by ATM.

- Open up your Branch Loan app

- Select ‘My Loan’

- Click on ‘Tap to pay

- Put in the amount of money you intend to payback

- Select your preferred method of payment – bank or debit card

- And click ‘continue’. It will direct you to your various account where you will proceed in making payments. Ensure you give the details as per the instructions and payment will be reflected within 24 hours.

How To Make ATM card payments in the Branch app

First, go to My Loan clicking the round ‘Tap to Pay’ button displayed. Select amount to repay either Net Amount, Other amounts (key in the amount you wish to pay), or Total Balance. Select one option and hit continue

Add details of ATM such as Card Number, Card expiry date (month and year of expiry) and CVV (3-digit number at the back of the Card) then again hit continue.

Proceed by selecting your auto-debit setting, payment Option, and tap continue. (Not all banks will request for your pin or forward security code to your registered sim card.)

Now, it’s successful and reflection will be effected immediately. DONE.✅

How To Repay Branch Loan in Kenya through M-Pesa

Here is the guide using M-Pesa; open the M-Pesa menu on your phone, choose Lipa na M-Pesa option,

then enter the pay bill number – enter branch Loan pay bill 998608 – then continue to account number – account number you registered with i.e. your Safaricom number

Key in the account number. The account number refers to the mobile number you registered with on the Branch. In this case, it is your Safaricom number. Key the amount you want to repay, enter the M-Pesa pin and accept the transaction.

At this moment, you’re done and M-Pesa will send you a message confirming the transaction.

Frequently asked questions

- Is there a Swahili version of Branch?

Yes! Kindly ensure you are using the latest version of the app. Then from your app, go to “My Account”, tap “Edit” next to “Language”, choose “Kiswahili” and tap “Submit” to save. - Can I delete my account?

If you would like to delete your account, please make sure that you have repaid all of your loans and then write to us on the in-app chat with your request. - How fast will my loan size increase?

Each loan amount is automatically determined by our systems each time you repay based on several factors. We encourage you to keep making your repayments as scheduled to increase your loan amount. - Can I apply for a higher amount than shown?

Unfortunately, you won’t be able to access a loan of a larger size. The fastest way to increase the amount you are eligible for is to build credit by making each repayment as scheduled. - Why was I rejected for a loan?

If you don’t get accepted when you apply, don’t worry! Sometimes it may take several attempts to qualify for a loan. We encourage you to continue saving data on your phone and to reapply after the period stipulated.

Did we cover all your concerns,

Or,

Have any? Well, will help you.